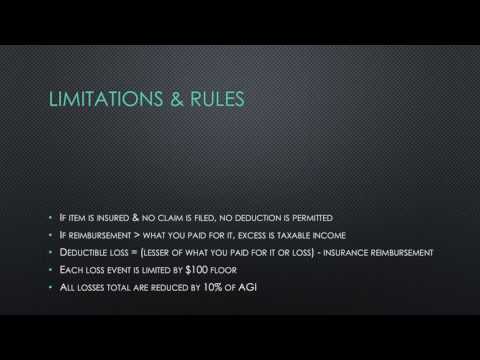

Hi, I'm Jeff Lovell, a staff accountant with Accounting Today. Today, I'd like to discuss the tax rules regarding deducting casualty losses. In order for a casualty loss to be deductible, it must be a result of an identifiable event that is sudden, unexpected, or unusual. Examples of qualified events include accidents, natural disasters, terrorist attacks, vandalism, and theft. There are certain damages that cannot be deducted, such as those caused by pets, intentional damage done by oneself (such as deliberately wrecking a car or burning down a house), or damages from termites, moths, or natural wear and tear. Additionally, theft losses of property from a spouse leaving or a reduction in stock value due to company fraud cannot be deducted. To receive a deduction, you must file a claim for any insured item. If the insurance reimbursement is greater than the original purchase price of the item, the excess amount is considered taxable income. The deductible loss on your tax return is typically lower than your actual economic loss. This is due to a rule that requires you to consider the lesser of the original purchase price or the actual economic loss - including insurance reimbursement - when calculating the deductible loss. Each loss event must be considered separately, and for each event, a $100 floor applies. Additionally, all losses for the year must be reduced by 10 percent of your adjusted gross income to determine the eligible deduction. Let's consider the example of Bob in 2015. Bob experienced several losses throughout the year, including a storm that completely destroyed his house and the theft of his car and laptop. While his house and car were insured, his laptop was not. On the table, we can see Bob's cost basis (the original purchase price) for each item, his actual economic loss (the current value of the...

Award-winning PDF software

4684 hurricane harvey Form: What You Should Know

As a result, it affected every U.S. state, including Alaska. (Source: IRS.gov) There was limited relief for U.S. Taxpayers in the case of Puerto Rico as well as the U.S. Virgin Islands. Because Puerto Rico was hit by storm during the “deadline” for filing extensions, many had to delay or not file their tax returns in late 2025 or early 2018. The tax season began on October 26 and ended December 21. For U.S. taxpayers, the federal rules for hurricane damage are very different from the state rules. A. Qualified disaster losses. For purposes of both the casualty and theft rules, losses from disasters are considered qualified disaster losses and may be excluded from gross income. Therefore, if you have an investment property that suffered storm damage in a federally declared disaster, such an investment property is qualified unless that property is in a disaster-impacted area. “Hurricane-related casualty losses” are defined as qualified disaster losses (FDP) arising from the following: Flooding, which has a federal disaster declaration. Land erosion, which has a federal disaster declaration. Storm damage to a building or facility. If any of these losses are greater than your basis in the investment property, you will lose the excess loss. You will have a nonqualifying FDP or a qualifying FDP. If you have a qualifying FDP as defined above, for each qualified disaster loss you have, you will have to include in your income the amount of the excess loss, and, for the years after the disaster, you will have to include in income the excess loss amount for each qualified disaster loss, over your basis in the investment property. Qualified disaster losses are reduced by any state and local disaster income tax. A hurricane-related FDP is the amount of your qualified disaster loss less your basis in the investment property. In other words, loss from a qualified disaster is one of the allowable items to reduce or eliminate itemized deductions, which are deductible items, “If, the basis in your gain upon a sale occurs in a disaster-impacted area, this gain and gain upon any subsequent sale will be treated as disaster relief expenses in the normal taxpaying sequence, after adjustment for any federal and state exclusion under IRC sec. 172.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4684, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4684 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4684 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4684 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4684 hurricane harvey